The volume of loans was maintained in 2020 following the amounts saved by the population and companies in banks, since the growth rate of loans has slowed down, while the deposit rate is more than double that of the advance of loans. loans.

The still low volume of loans relative to deposits shows that there is scope for intensification of credit, and banks also have the capital and liquidity necessary to finance the recovery of the economy after the coronavirus crisis.

Specifically, the deposit growth rate in 2020 was 2.6 times faster than the loan advance.

The annual growth rate for loans remains modest, at around 5%, the lowest in the last four years.

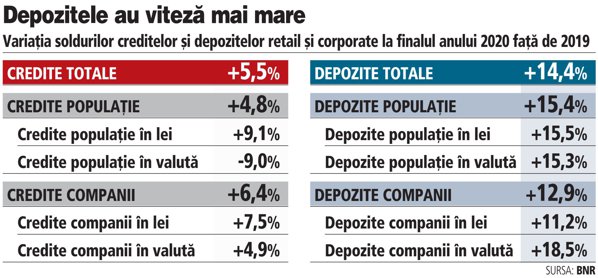

In December 2020, the total credit balance was 5.5% higher than the level at the end of 2019. For the entire year 2020, the average growth rate of total private credit slowed to 5.1%, below of the average credit growth rate in 2019 of 7.6%, and the loan balance reached 282.4 billion lei at the end of last year, according to data from NBR.

In comparison, in December 2020, deposits had an advance of 14.4% compared to the closing level of 2019, the balance of the amounts saved by the population and companies in the banks reached 420.8 billion lei . The average growth rate of total deposits for the whole of 2020 was 13.4% year-on-year.

Total deposits exceeded the balance of total private loans by 138.4 billion lei last year.

Total private credit started 2020 with an annual increase of 6.9% compared to the same month in 2019, so in February the annual advance will reach 7.6%, and in March it will return to 6.9%. Throughout the first quarter, total private credit increased 7.1% and lei credit increased 9.6%. However, subsequent loans began to slow to 5%.

A change in trend that became visible in July 2020 and lasted until the end of the year was the entry of private loans in foreign currency into negative territory.

Foreign currency lending had returned to positive territory in 2019, after declining in 2018, and the increase continued in the first half of 2020.

Analyzing the evolution of credit during 2020 by component, it is observed that the population preferred credit in lei, while companies relied more on loans in euros. For lei loans, the average growth rate of loans to the population in 2020 was 11.3%, while for companies it was only 2.4%. On the other hand, in loans in foreign currency, credit to the population decreased at an average rate of 8.5%, while loans to companies increased at an average rate of 6.08% year / year.

In recent years, banks have been forced to rely more on local funding sources as they have lost some of their funding from parent banks, which were the main engine of growth during the economic boom. † For financing, banks relied mainly on the resources attracted from individual clients, which are more stable and which in the crisis period showed strong growth, amid more cautious consumer behavior.